pa educational improvement tax credit election form

Irrevocable election to pass Educational Improvement Tax Credit EITCOpportunity Scholarship Tax Credit OSTC through to shareholders members or partners. HARRISBURG PA 17128-0701 EDUCATIONAL IMPROVEMENT TAX CREDIT ELECTION FORM See Page 3 for instructions.

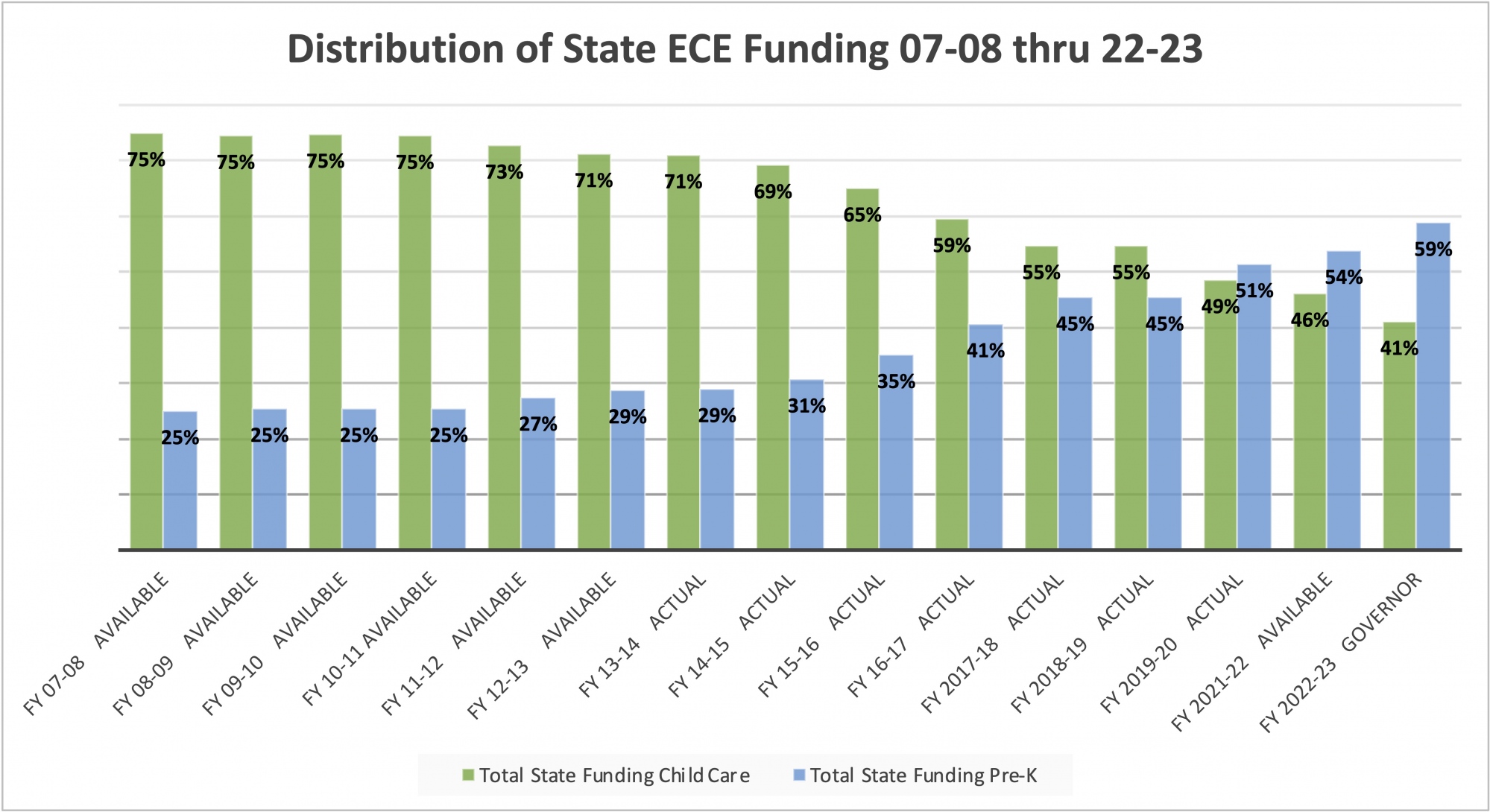

State Policy Budget Issues Pennsylvania Child Care Association

Other pennsylvania corporate income tax forms.

. Pennsylvanias Educational Improvement Tax Credit program helps tens of thousands of students access schools that are the right fit for them but policymakers could do more to. FILL IN FORM MUST BE DOWNLOADED ONTO YOUR COMPUTER PRIOR TO COMPLETING EX 12-20 REV-1123 BUREAU OF INDIVIDUAL TAXES PO BOX 280604. For the 2022-23 school year the maximum scholarship award available to non-special education students is 8500 and the maximum for a special education student is 15000.

To pass through an Educational Improvement Tax Credit or Opportunity Scholarship Tax Credit the taxpayer must com - plete and submit REV-1123 Educational Improvement Tax Credit. A separate election must be submitted for each year an EITCOSTC is awarded. In a matter of seconds receive an electronic document with a legally.

The efficient way to. The efficient way to create educational improvementopportunity scholarship tax credit election form rev 1123 educational improvementopportunity scholarship online is by using a dedicated tool. A separate election must be.

Other pennsylvania corporate income tax forms. Irrevocable election to pass Educational Improvement Tax Credit EITCOpportunity Scholarship Tax Credit OSTC through. PSERS Forms Publications and Presentations.

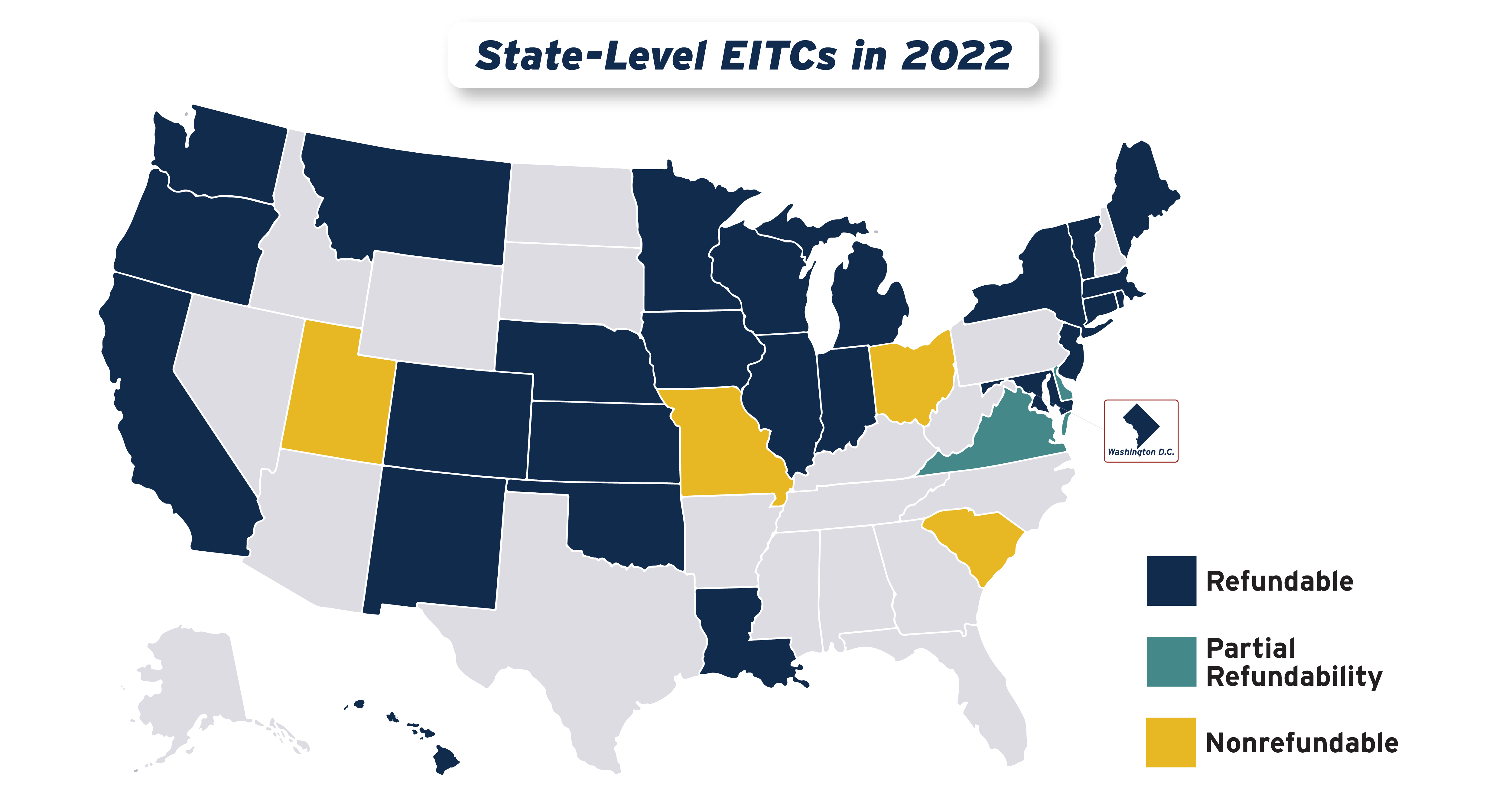

The Educational Improvement Tax Credit EITC is available to. Donate at least 3500 in one check to the SPE. EDUCATIONAL IMPROVEMENT OPPORTUNITY SCHOLARSHIP.

Pa 1123 formtional improvement opportunity scholarship tax credit election form rev 1123 495193552 on the go. The Educational Tax Credits program contains two sections of which credits may be awarded for applicants within the program. To shareholders members or partners.

Individual Donor Requirements. This translates to a tax credit of 3150 which will be usedrefundable if.

Rev 1123 Ct Educational Improvement Opportunity Scholarship Tax Credit Election Form Free Download

New Pa Budget Injects 125m Into Private School Tax Credit Program That Lacks Accountability Triblive Com

The New York Pass Through Entity Tax Election Freed Maxick

Pa Program Gives Tax Credits For Helping Students But Companies Need To Act Fast Boyer Ritter Llc

How To Form An Llc Advantages Disadvantages Wolters Kluwer

Tax Reconciliation Cheat Sheet The National Academy For State Health Policy

Pennsbury School District Holds First Ever Zero Waste Day Thereporteronline

Form Rev 1123 2011 Educational Improvement Tax Credit Election Form Rev 1123

Pa Home Improvement Renewal Application Fill Out And Sign Printable Pdf Template Signnow

Form Rev 1123 Download Fillable Pdf Or Fill Online Educational Improvement Opportunity Scholarship Tax Credit Election Form Pennsylvania Templateroller

Educational Improvement Tax Credit Eitc Program Grow Pittsburgh

![]()

Educational Improvement Tax Credit Program Eitc Pa Dept Of Community Economic Development

Educational Improvement Tax Credit Eitc Program Grow Pittsburgh

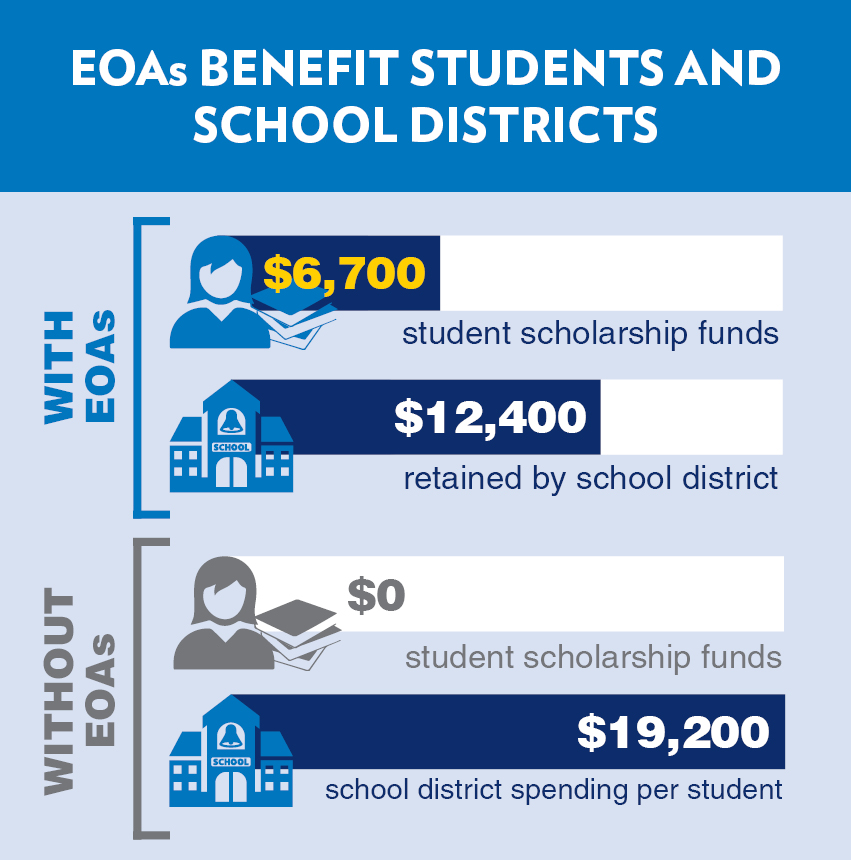

How To Create A Better Pennsylvania In 2023 Commonwealth Foundation

Cbicc Covid 19 Resource Response Center

Form 8832 Instructions A Simple Guide For 2022 Forbes Advisor

Eitc News And Spe Information Central Pennsylvania Scholarship Fund